VIPR Connect Industry Profiling

The Industry Profiling system (IPS) is specifically geared towards assisting research providers/universities to identify industry funders, research partners, contract research clients and potential IP licensees. The IPS can enhance Research Provider/University-Industry linkages by identifying industry needs and matching these with research capacity and capability. The combination and depth of information provided is unique to the IPS and is not available in any other commercial product. Profiles can be narrowed down by country, state, type (including not for profits, charities, government entities, private and public companies to name a few), size, keywords and discipline/subject area.

Using the key criteria and combining this with an analyst's review of specific industry organisational needs, industry organisations can be shown highlighting which are highest ranked in terms of being a best fit to your needs.

Research analytics prioritises key information across a range of metrics to help identify which industry organisations best match your institution’s strengths and can assist in assessing the commercial funding viability of targeted strategic planning.

Forming Partnerships with Industry

The successful partnership between industry and university relies on many factors. The evaluation of an industry partner is a critical initial step of the process.

The strategic alignment of the industry partner and university is vital so as the needs of both parties are met.

Partnerships between university and industry organisations is an increasingly relevant factor to the overall growth, development and success of your organisation.

The benefits of partnering with industry for your research can include:

- Increased quality of research, essential for innovations

- Public and private funding opportunities

- Increased income through licensing and patenting and creation of start-ups and spin-offs

- Potential employment opportunities for students

- Practical real-world experience for students and researchers bringing more knowledge, skills and experience to the university

- Increased resources to undertake research and therefore diversify research areas

- Developing a strong industry network that will aid future industry collaborations

- Enhanced reputation and status within the research community

Key Metrics Used in the Rating of an Industry Organisation

DISCIPLINE/SECTOR

key business/discipline area of the organisation including both primary and alternate areas

PREVIOUS RnD FUNDING

known history of funding research and development, establishing a track record and funding trends showing where money is being spent

FINANCIAL SUPPLY

funding capacity both current and ongoing

STIMULUS

specifics contributing to the need, problems, identified benefits of a research partnership and other information known about the organisation which may contribute to the overall capacity to fund.

Data Sources

At the core of the VIP-Research Industry Profiling component is a structured methodology and process used to map and match the industry data and publish this in a way that the user can ascertain which industry organisations they might pursue. This methodology uses publicly available data from the Australian & NZ company registers, company annual reports, market analyses and similar USA and UK sources to assist in identifying the most likely industry partners.

The database has approximately 2,000 industry profiles in its database and this is expected to be expanded to approximately 5,000 profiles over 2019.

Key Criteria & Ratings

Each organisation is rated according to how well matched it is to your key criteria. Metrics used include:

discipline/sector (key business/discipline area of the organisation including both primary and alternate areas); financial supply (funding capacity both current and ongoing); stimulus (need, specific problems, identified benefits etc); history of funding research (track record where available and analysis of any specific issues which may contribute to the overall suitability to fund research e.g. acquisitions

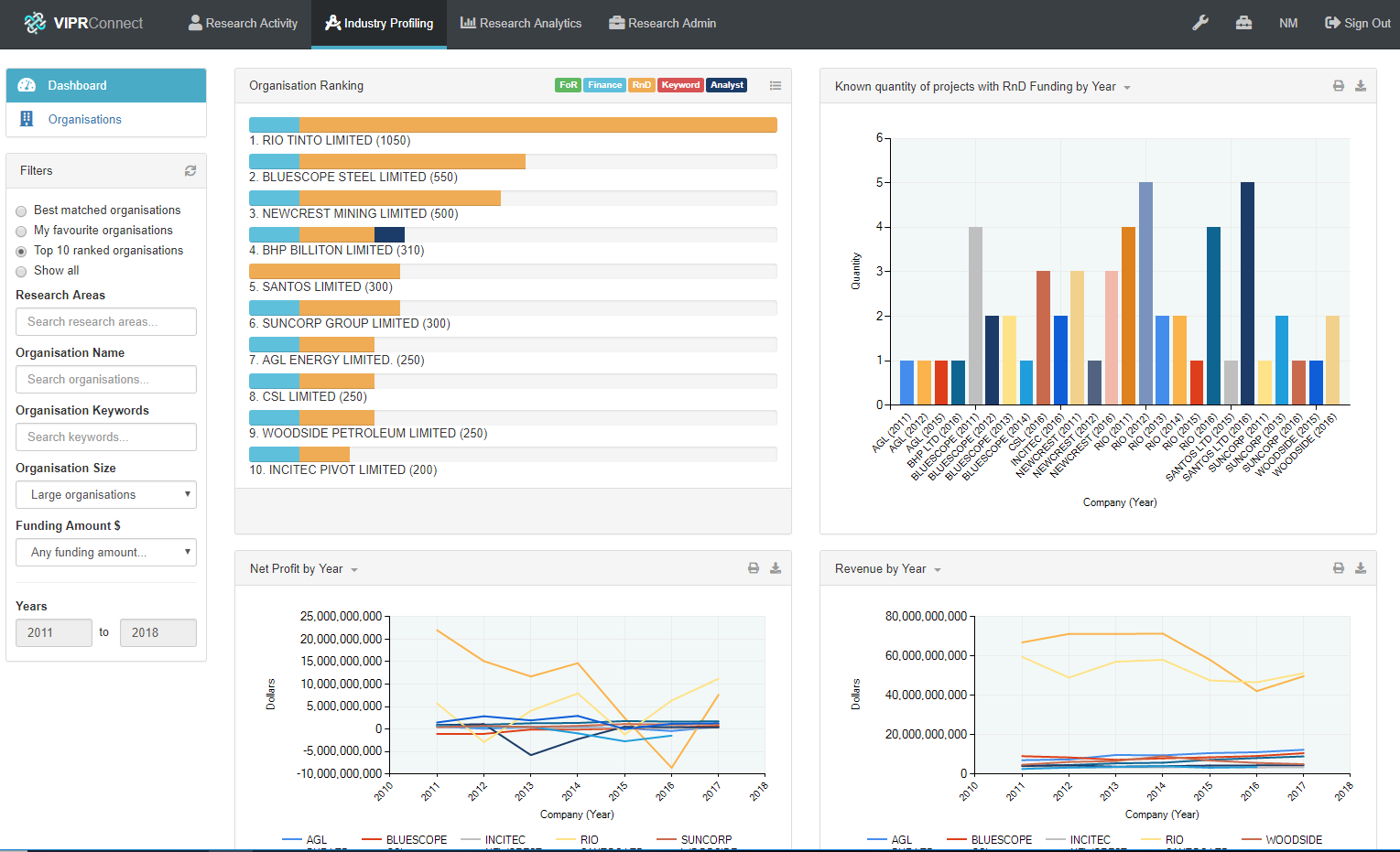

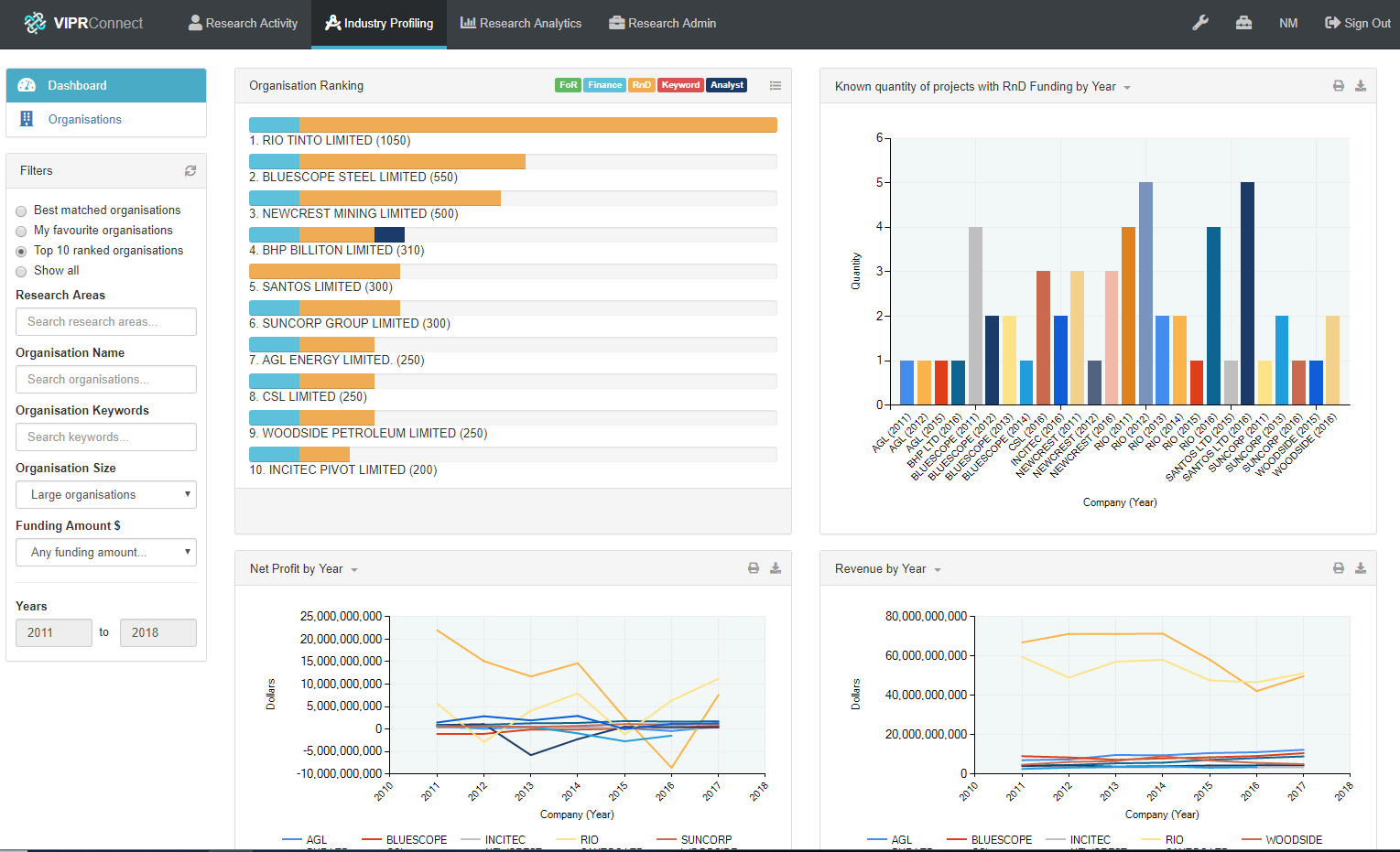

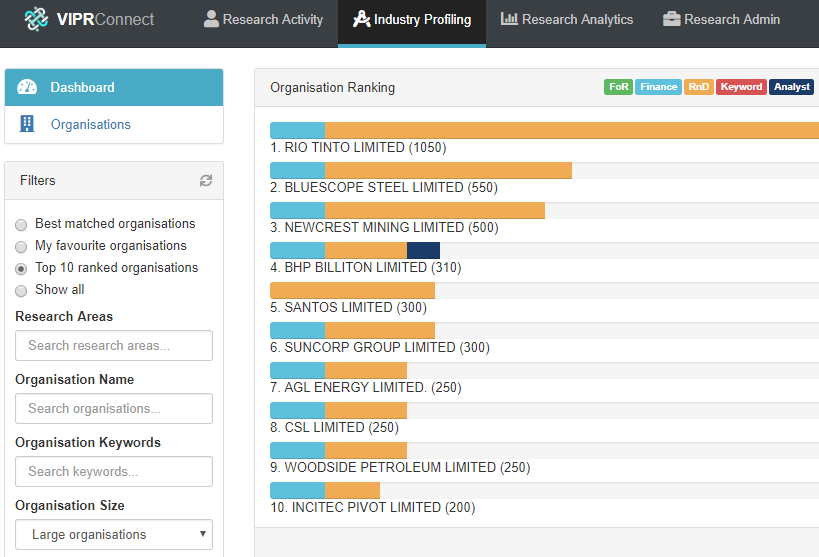

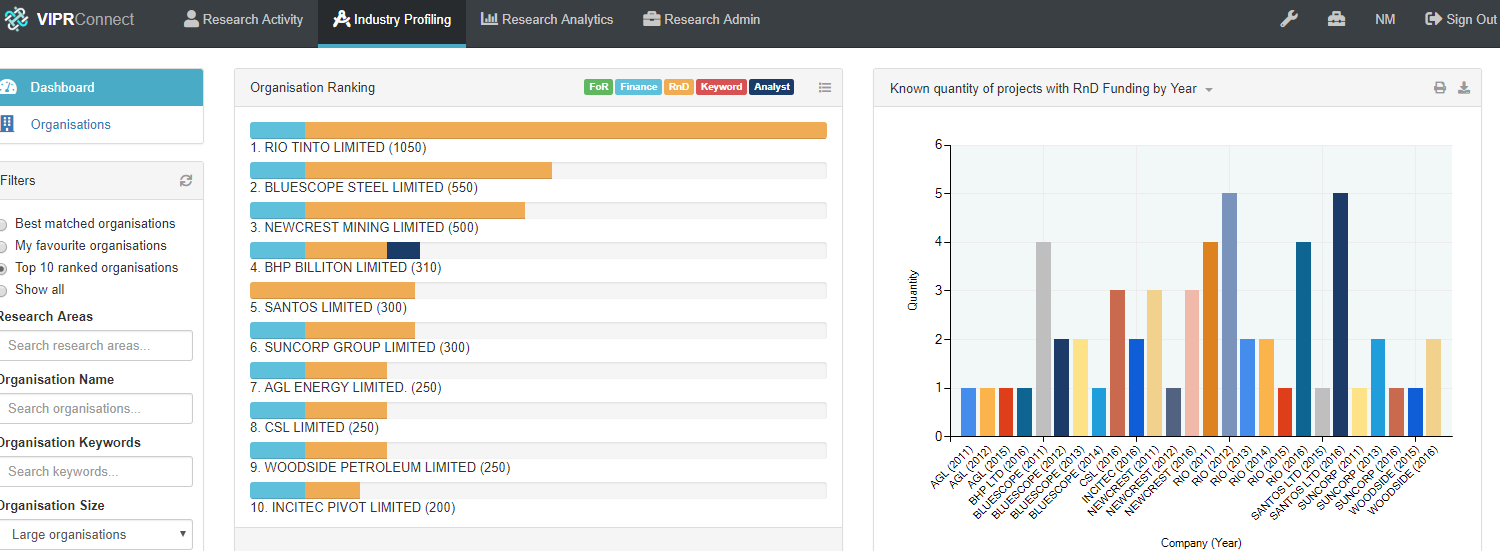

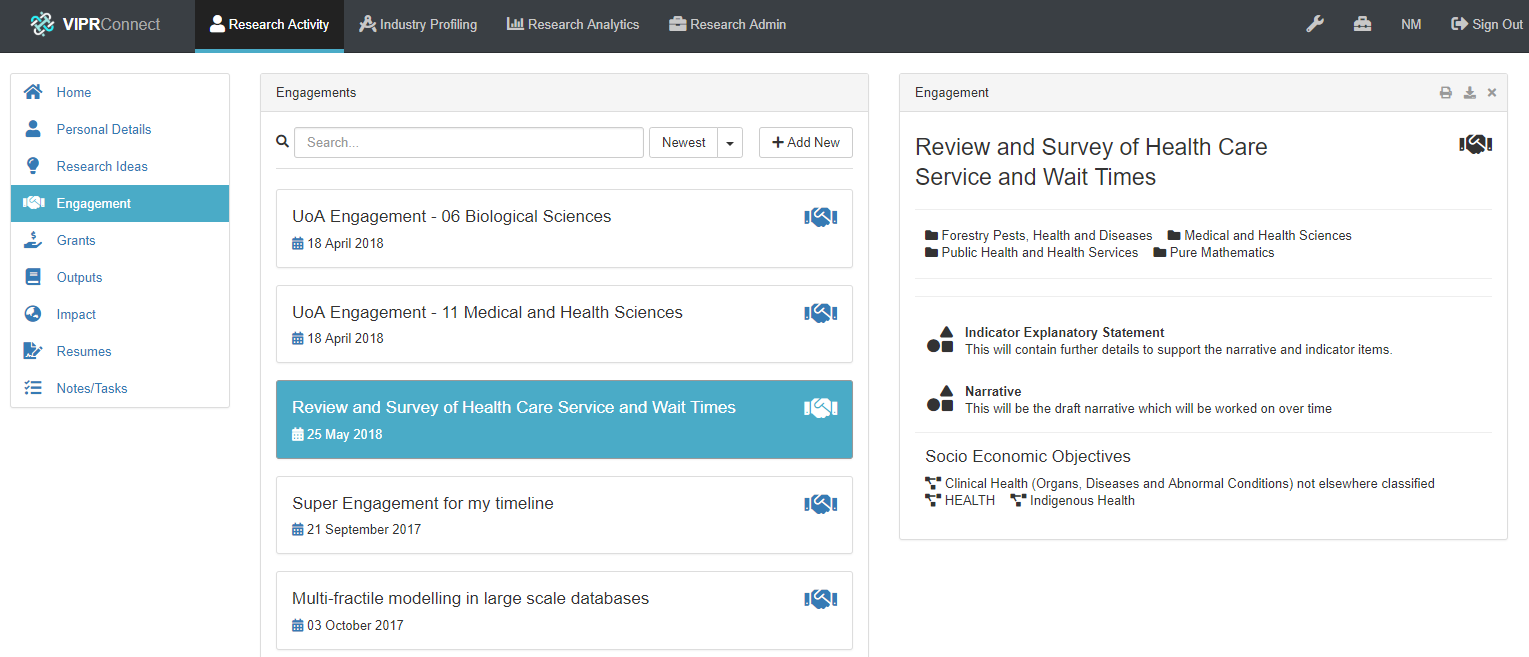

Industry Organisations Best Matched to Your Needs

Using a series of key criteria and combining this with an analyst's review of specific industry organisational needs, industry organisations are displayed, ranked in terms of being a best fit to your needs. Details are provided for each organisation so as you can compare metrics like funding capability, previous RnD history and key areas of research.

VIPR Connect provides the matching organisations ranked in terms of the best fit to your criteria entered. It also provides further data about each organisation to not only gain a more detailed understanding of companies to consider, but also to help identify their potential motivation to provide funding. This information can assist greatly in narrowing the search.

Profile Data Provided for Further Interrogation

Industry profiles can be examined in order to assess best matches for your research needs. Examples of the additional data provided include:

A breakdown of each of the key ratings criteria (discipline, finance, RnD track record) showing where the rating leaders had their highest ratings and where other companies rated better; Past history of RnD funding for external research providers that are available on public record; Metrics of various companies reviewed showing their key fiscal capabilities based on trends over recent years. This can include net profit, revenue, staffing, payout ratios etc. ; Analysts comments that may highlight specific RnD needs/benefits for the companies; Competition analysis showing which other research providers have demonstrated their ability to attract funds from that Industry Sector, i.e. competitor analysis